to have managed consistently strong growth in market share at home and abroad (half of that shelf space is now overseas), profits and shareholder value in this period of consolidation of the UK retail sector, while taking massive chunks of business from clothing, electronics, financial service and other non-food sectors. The craft retailer Waitrose has also prospered.

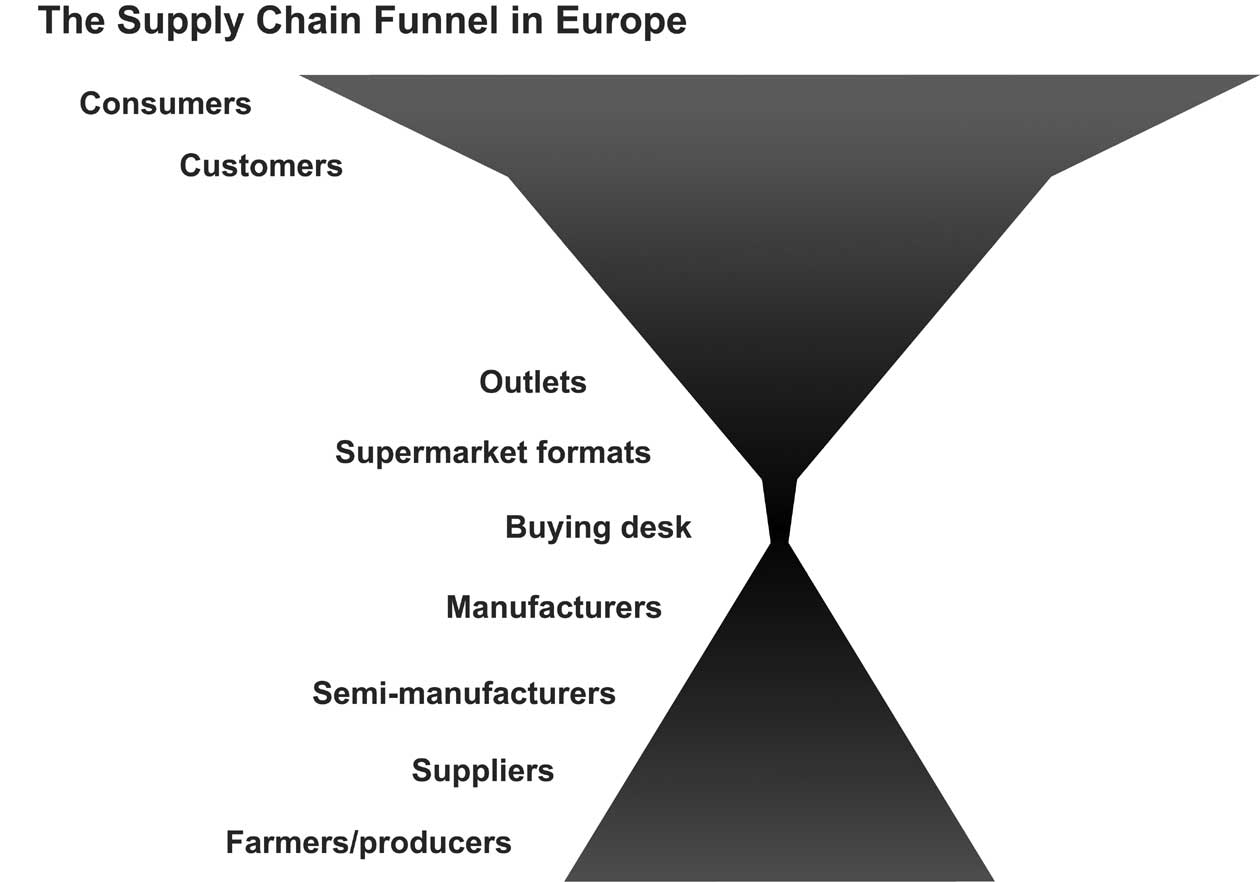

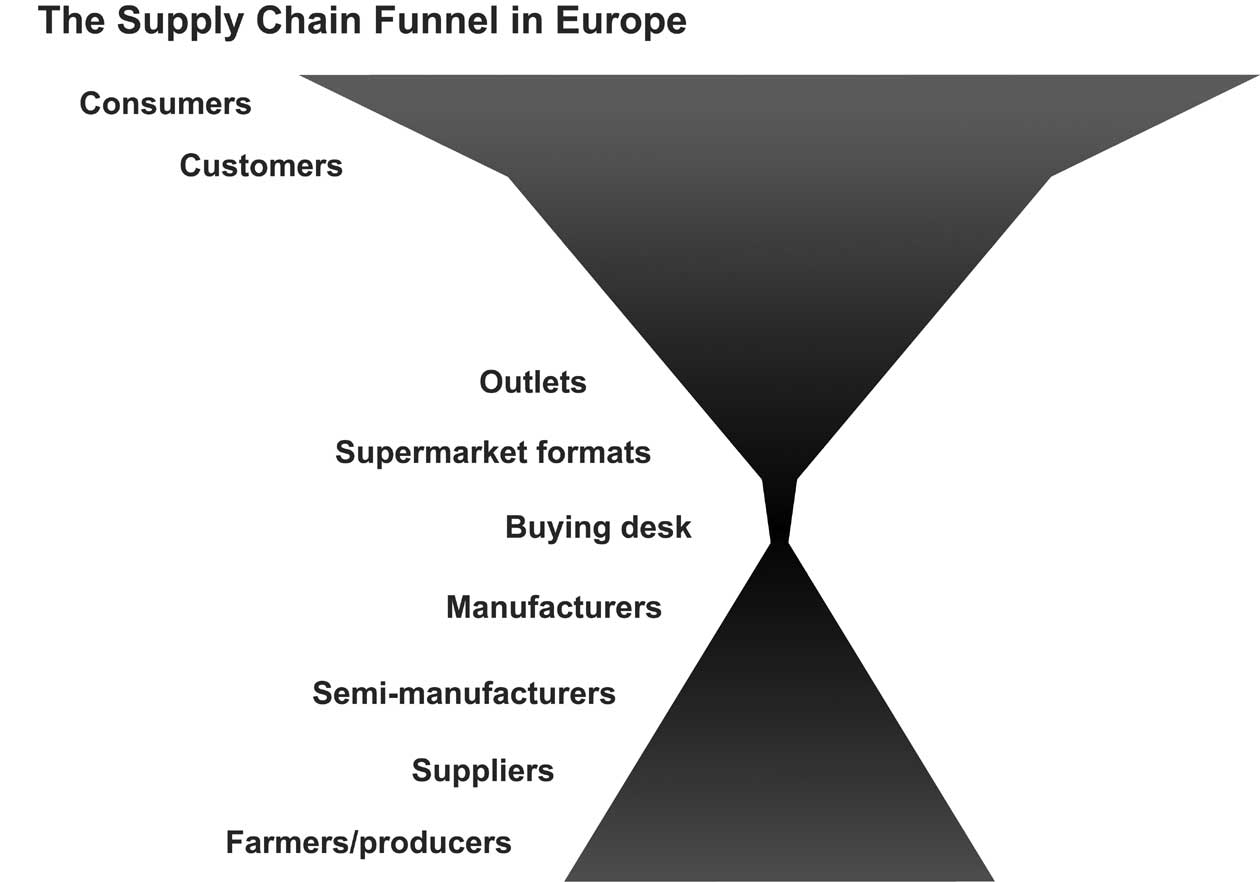

Primary producers and suppliers are feeling the squeeze on prices. In a recent survey of farmers by Farmers Weekly magazine, a massive 95% of those questioned were concerned about power imbalance between buyers and suppliers, saying that the government must find ways to make trading relationships between retailers, processors and producers more equitable. Caribbean banana producers have called the price war "perverse transfer of wealth, by some of the supermarkets, from farmers and farm workers of developing countries to the consumers of developed countries" and "anti-development and regressive" (Eurofruit, 2004).

Despite investigations by the Competition Commission in 2000 and again in 2003 (around the Safeway takeover by Morrison's) and the resulting Supermarkets Code of Practice and subsequent review by the Office of Fair Trading, it is clear that consumer interests remain dominant over those of suppliers in the eyes of the Office of Fair Trading. Indeed, the situation in the UK around producer-supermarket trading can only be described as policy paralysis.

The UK independent retail sector is in steep decline, with a 7.4% decline in the number of corner shops in the last year alone. Industry watchers say 30,000 local shops—including specialists such as butchers, bakers and greengrocers—will be lost in a decade.

In North America, food retailing had a relatively slow pace of consolidation. A major wave of consolidation happened in the late 1990s, when Albertson's Kroger became the first coast-to-coast supermarket chains. By 2001, Kroger and Albertson's were the largest US grocers. However, Wal-Mart, which until the early 1990s had never sold any groceries, became the largest grocery retailer in 2004, with about 15% of the US grocery market. In Canada, Loblaw's |

|

is the dominant grocer in the Canadian market, with Sobey's competing for the number two position.

Today, the top five supermarket chains (Wal-Mart, Kroger, SuperValu, Safeway and Ahold) account for almost 50% of food retail sales in the United States (Table 2-10). By comparison, the top five food retailers accounted for only 20% of food sales in 1993.

When Wal-Mart entered the supermarket business in the mid-1990s, other stores were wary because of the incredible logistics system and supplier pricing that Wal-Mart brought to the business. More importantly, Wal-Mart's large size and market power caused concern as it integrated backward in the food system by creating relationships with the dominant food chain clusters. Wal-Mart is one of the first supermarkets to use case-ready meat in its stores.

The end of the 20th century saw the emergence of truly global food retailers like Carrefour, Wal-Mart and Tesco. Considering the rapid consolidation of the Latin American supermarket industry by transnational firms, development policy will need to respond to the resulting exclusion of

Table 2-10. Food retailing in the USA.

Supermarket* |

Grocery Sales (billion $) |

Wal-Mart Stores |

66.5 |

Kroger Co. |

46.3 |

Albertsons, Inc. |

32.0 |

Safeway, Inc. |

30.0 |

Ahold USA, Inc. |

25.1 |

Historical CR5 |

1997 |

2001 |

2005 |

|

24% |

38% |

46% |

*Progressive Grocer reports only grocery sales from supermarkets, and does not report general merchandise, drug or convenience sales. In the 4/15/04 issue, it reported that total 2003 supermarket sales were $432.8 billion in the U.S. Note: CR5 refers to concentration ratios of the market share of top 5 firms Source: Planet Retail, 2007.

|