| Previous | Return to table of contents | Search Reports | Next |

| « Back to weltagrarbericht.de | ||

Changes in Agriculture and Food Production in NAE Since 1945 | 35

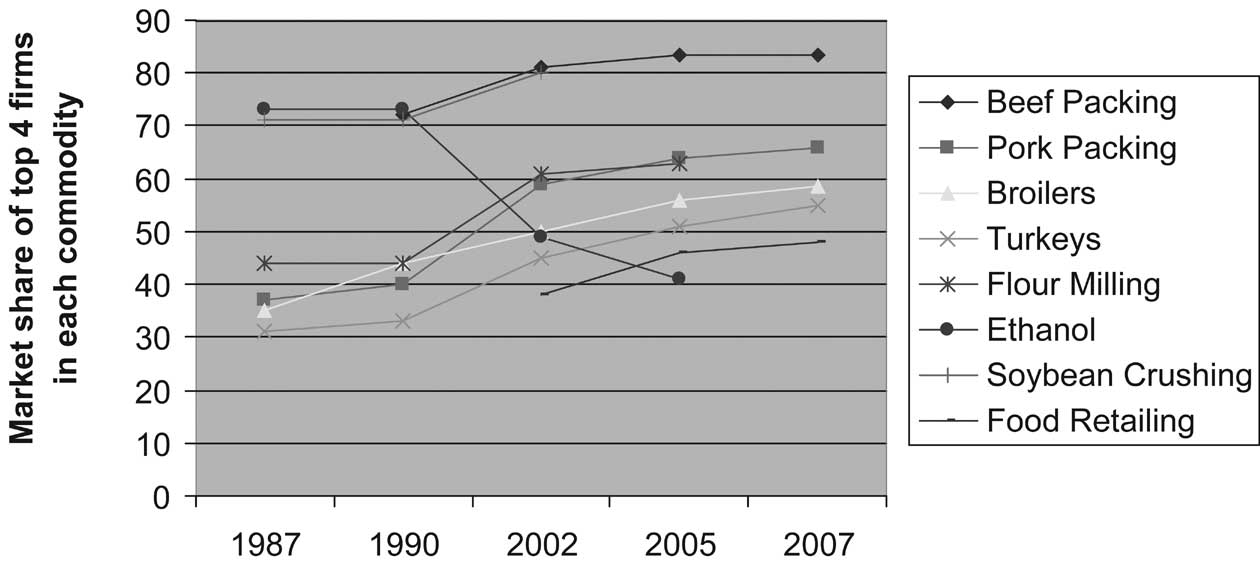

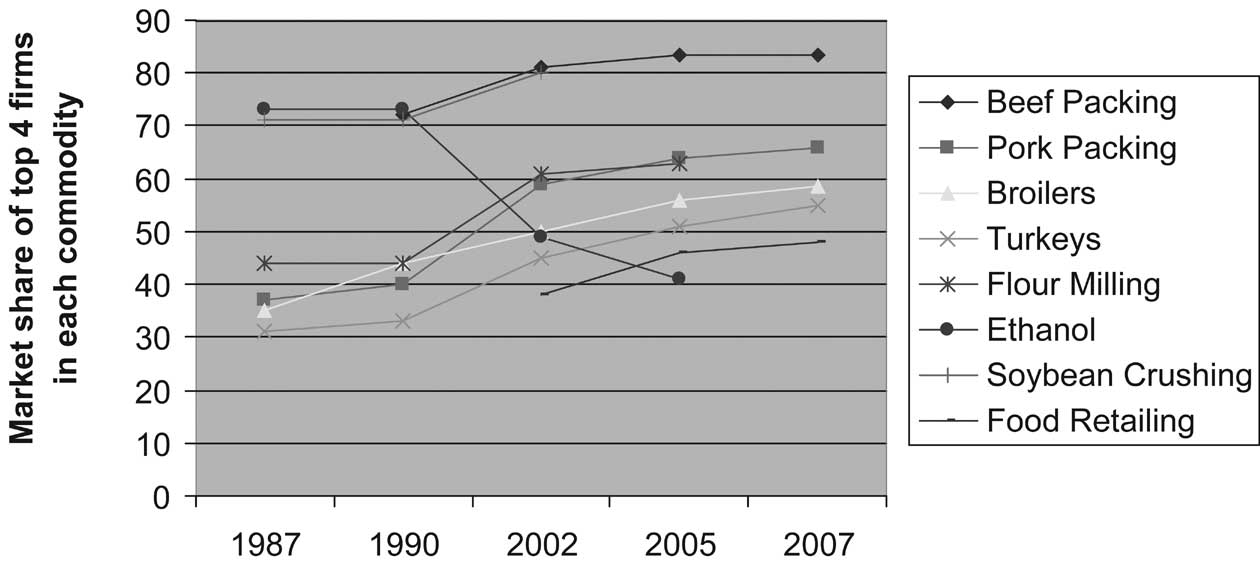

Table 2-3. Concentration in the U.S. and Canadian food industry.

| Commodity Market and Top Firms | 2007 Concentration Ratio* | Historical CR4 | |

| Beef packing (Tyson, Cargill Excel, Swift & Co, National Beef) | CR4=83.5% | CR4=72% (1990) | |

| Pork packing (Smithfield, Tyson, Swift & Co, Hormel) | CR4=66% | CR4=37% (1987) | |

| Broilers (Pilgrims' Pride, Tyson, Perdue, Sanderson Farms) | CR4=58.5% | CR4=35% (1986) | |

| Turkeys (Smithfield/Maxwell Foods, Hormel, Cargill, Sara Lee) | CR4=55% | CR4=31% (1988) | |

| Flour milling (Cargill/CHS, ADM, ConAgra) | CR3=55% | CR4=40% (1982) | |

| Soybean crushing (ADM, Bunge, Cargill) | CR3=71% | CR4=54% (1977) | |

| Food retailing (Wal-Mart, Kroger, Albertson's, Safeway, Ahold USA) | CR5=48% | CR5=24% (1997) | |

| Selected information about concentration in the Canadian agriculture and food industry | |||

| Commodity market and top firms | Concentration Ratio, 2006 | ||

| Beef packing (Cargill, Lakeside Packers [owned by Tyson], XL Foods) | CR3=75% | ||

| Durum milling (ADM, Robin Hood Foods [owned by J.M. Smucker Co]) | CR2=57% | ||

| Flour milling (ADM, Robin Hood Foods [owned by J.M. Smucker Co]) | CR2=57% | ||

*Concentration Ratio refers to the market share that the top four firms (or three as in the case of soybean crushing, and five in the case of food retailing) control. Concentration Ratios are calculated using statistics reported in trade journals. Source: Hendrickson and Heffernan, 2006, 2007.

Livestock production in Europe is less consolidated than in North America. For instance, the top 10 integrated broiler producers in Europe account for only 36% of production compared with 66% in the US. |

|

largest dairy processor, controlling 30% of the US milk supply (Hendrickson and Heffernan, 2005). Retail consolidation in dairy increased prices for consumers, yet decreased farm gate prices (Cotterill and Franklin, 2001). Across Europe, there has been a process of international consolidation in dairy processing, led by farmer-owned businesses, in the race to remain competitive with multinational companies. Concentration in dairy is also a trend in Central and Eastern Europe (Csaki et al., 2004). |

Figure 2-6. Trends in consolidation in the US food industry from 1990 to 2007. Source: Hendrickson and Heffernan, 2007

| Previous | Return to table of contents | Search Reports | Next |

| « Back to weltagrarbericht.de | ||