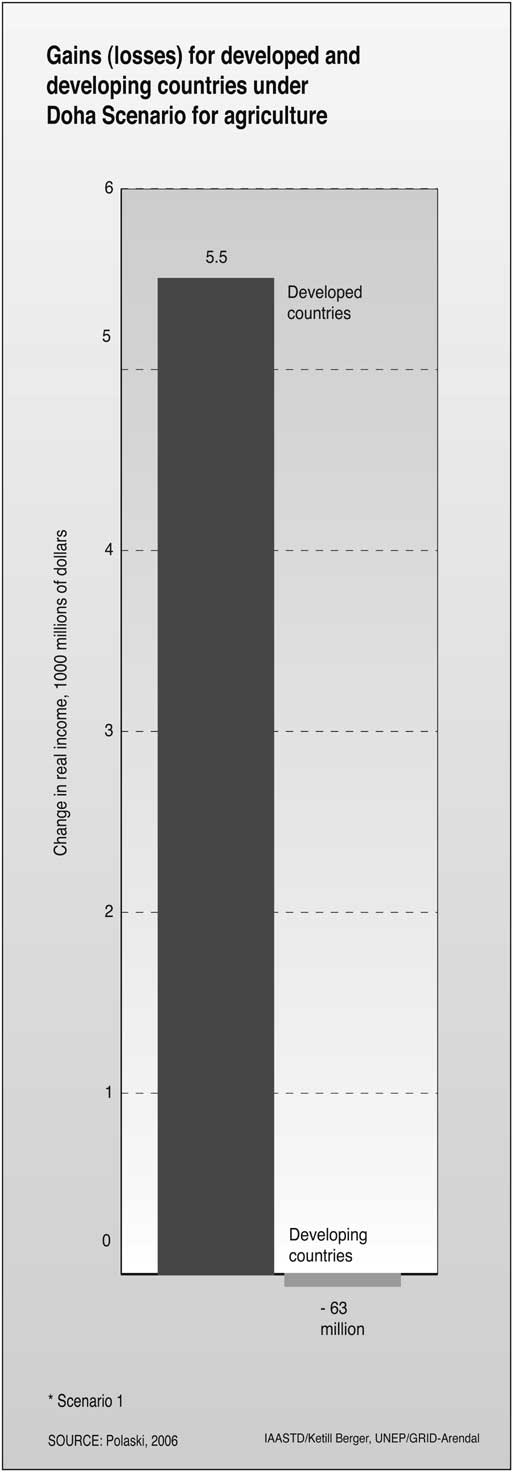

Figure 7-3.Projected gains (losses) for developed and developing countries under Doha scenarios for agriculture.

7.2.3.3 Meeting new regulatory costs associated with international trade

Developing countries are facing significant new regulatory costs related to international trade, e.g., meeting international SPS standards, with fewer resources due to tariff revenues losses (which represent a significant percentage of collected tax revenues in many countries). For many countries, decreased tariff revenues means decreased funds available for social and environmental programs and agriculture sector development, as other taxes (such as consumption taxes) can be politically and administratively difficult to collect. Concern that the high costs of regulatory measures to comply with sanitary and phytosanitary standards will divert resources from national food and animal safety priorities is an example. The fundamental practical question of how developing countries can advance sustainability and development objectives without significant increases in donor driven efforts is noted across the developing South.

Tariffs represent about a quarter of tax revenue in developing countries; other taxes are hard to collect in poor countries, particularly with large informal sectors (Panayatou, 2000; Bhagwhati, 2005). Tariff revenue reduction as a result of liberalization can represent a significant proportion of government revenues (Díaz-Bonilla et al., 2002; FAO, 2006c). This compounds the effects of structural adjustment programs, which weakened the institutional capacity of developing governments to carry out basic functions such as tax collection, enforcement of laws, and provision of basic health, sanitation and education services (Jaramillo and Lederman, 2005).

7.2.4 Policy options to address the downward pressure on prices for the small-scale sector

7.2.4.1 Subsidies

Price stability at remunerative prices is an important factor in determining farmer's capacity to invest and innovate rather than pursue low-return, risk-averse behavior (African Group, 2006; Murphy, 2006). Reducing or eliminating agricultural subsidies and protectionism in industrialized countries, especially for those commodities in which developing countries compete (e.g., cotton, sugar and groundnuts) is an important objective of trade reform to reduce the distortionary impact in those markets (Figure 7-6) (Díaz- Bonilla et al., 2002; Dicaprio and Gallagher, 2006; Nash and McCalla, 2007).

For developed countries agriculture is a very small share of the economy and employment, yet subsidies and other supports are highest, unfairly tilting the benefits of agricultural trade in their favor (Watkins and Von Braun, 2002). Agricultural research, farmers' support and investment in infrastructure have also been greatest in these countries (Pardey and Beintema, 2001). The xesult is increased concentration of agricultural production capacity in the very few countries. This leads to a relevant question: where are subsidies used, what would be the impact of their elimination on the redistribution of production capacity? Developing country income would be some 0.8% higher by 2015 if all merchandise trade barriers and agricultural subsidies were removed between 2005 and 2010, with about two-