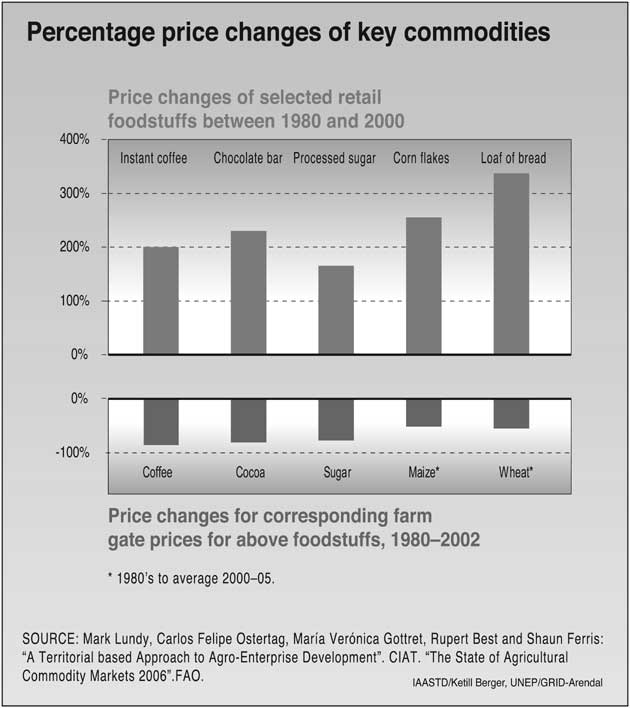

Figure 7-6.Price change of key commodities. Source: Lundy et al., 2005.

mechathirds of the total gain coming from agricultural trade and subsidy reform (Anderson et al., 2005).

In globally integrated markets, international prices affect domestic prices across the globe, even for small farmers who grow only for the domestic market (Stiglitz, 2006). Nevertheless reducing trade distorting export subsidies in industrialized countries, although widely agreed to be necessary, is also acknowledged as insufficient by itself to establish higher world prices for many commodities. For example, the reduction or lifting of export subsidies by the US and EU is critically important for some commodities such as cotton, but is unlikely to have a large positive effect on developing countries as a whole, e.g., there will be a number of countries that gain but also a number of countries that lose (Ng et al., 2007). The short-run impact of global subsidy reform will largely depend on whether a country is a net importer or exporter of the products concerned. Countries such as Argentina, for which products subject to export subsidies for some WTO members constitute a large share of exports, are likely to benefit greatly from elimination of export subsidies. Conversely, countries such as Bangladesh that export virtually no products that are subsidized in industrial countries but import a substantial share of such products (13% of imports) are unlikely to benefit in the short run from removal of export subsidies (Ng, Hoekman, and Olarreaga, 2007).

Econometric simulations suggest that removal of trade distorting subsidies would increase agricultural commodity prices only modestly; for example, even cotton, which is heavily subsidized, would increase an average of merely 4 to 13.7%, depending on policy scenario assumptions, defined

baseline and other factors (Baffes, 2006). It is questionable however if such a price increase from depressed agricultural commodity prices reported by FAO (2005b) would suffice to reach the "normal" price, which, according to the WTO, is the zero degree of trade distortion.

Policy tools in addition to subsidy cuts may be needed to raise agricultural prices to remunerative levels (African Group, 2006). Proposals for a plurilateral commitment from major exporting countries not to allow trade at prices below cost of production (CoP)-dumping-and for OECD member countries to publish full CoP figures annually are options that merit further study. (Full CoP would include the primary producer's production costs + government support costs [Producer Subsidy Estimates] + transportation and handling on a per unit basis.) Publication of full CoP figures, when compared to freight on board (FoB) export prices would enable calculation of the percentage of the price that is dumped on world markets (Murphy et al., 2005). Further refinements of the dumping calculation methodology have been made in the context of determining the extent to which industrialized animal production receive input subsidies from below CoP feed grains (Starmer et al., 2006).

7.2.4.2 Supply management for tropical commodities

On average, prices of tropical products (taking dollar inflation into account) are only about one seventh of what they were in 1980 (UN General Assembly). Essentially, less income is earned as more commodities are produced. At the same time, retail prices of products made from coffee (roasted and instant coffee) have increased substantially over the same period. This phenomenon also applies to many other primary commodities produced by developing countries, e.g., cocoa, sugar, cotton, maize, spices. An OECD report acknowledges that "there is concern not only that oligopolistic retailing and processing structure will lead to abuse of market power, but that the lion's share of the benefits of any future reforms in the farming sector may be captured by the processors and retailers . . ." (Lahidji et al., 1996) (Figure 7-7).

The view on supply management held by most institutions and conventional economic perspective is that supply management has been tested and is too costly and prone to problems of free-riding and quota abuse. However, it is also the case that supply management is being used in many commercial markets, given this success a new approach to supply management, that is regulated through the private sector rather than government, may be an effective and fundamental solution to a growing world problem. A variant on this policy approach is to refocus global commodity supply management on the concept of sustainable development. The option suggests that the International Commodity Agreements (ICAs) could be reformed to reduce price volatility, building on the coffee, cocoa and sugar lessons of the 1980s.

The African proposal to explore supply management mechanisms is an option to achieve the production control mechanisms common to other economic sectors (African Group, 2006).

Policy options to help meet the sustainability and development objectives include a bundle of mechanisms to stabilize and increase prices. Supply management mechathirds